Roof Insurance: A Growing Concern for Homeowners

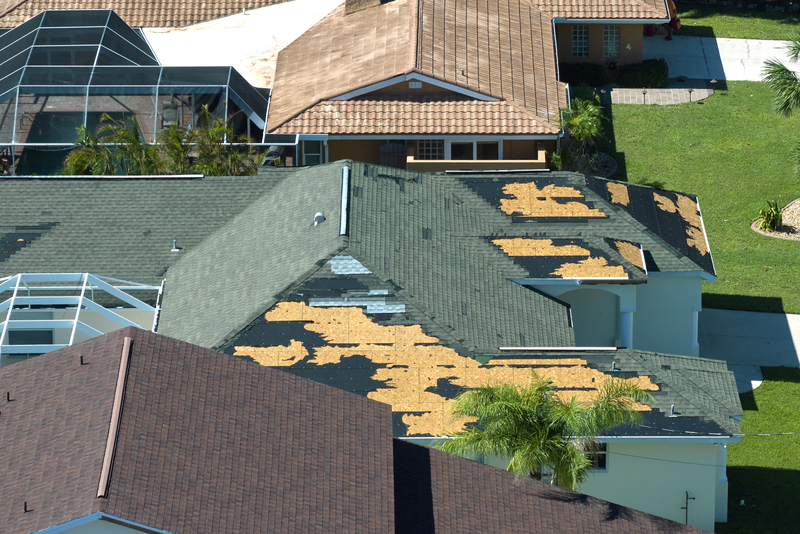

Hurricane Ian was a powerful storm that struck the coast of the United States in September 2022, causing significant damage to homes and businesses in its path. As with any natural disaster, homeowners were faced with the daunting task of rebuilding and repairing their homes, often with the added stress of navigating the complexities of their insurance policies. One area of particular concern for many homeowners was the issue of roof insurance.

Roof insurance is a specific type of coverage

Roof insurance is a specific type of coverage that is intended to protect homeowners from the financial burden of repairing or replacing a damaged roof. Many standard homeowners insurance policies include some form of roof coverage, but the specifics of this coverage can vary greatly from one policy to another. For example, some policies may only cover the cost of repairing a damaged roof, while others may include coverage for a full roof replacement. Additionally, some policies may have limits on the amount of coverage available for roof repairs or replacements, while others may have exclusions for certain types of damage.

In the aftermath of Hurricane Ian, many homeowners found themselves struggling to understand the details of their roof insurance coverage. Some discovered that their policies did not include enough coverage to fully repair or replace their damaged roofs, while others found that their policies had exclusions for damage caused by hurricanes or other natural disasters. In some cases, homeowners were even denied coverage entirely due to the age of their roofs or other factors.

Navigating the complexities of their insurance policies

For homeowners facing these challenges, the process of navigating the complexities of their insurance policies can be incredibly frustrating and stressful. It is important for homeowners to understand the details of their coverage and to review their policies carefully before a disaster strikes. This includes understanding what types of damage are covered, as well as any exclusions or limits that may apply. Homeowners should also consider the age of their roofs, as older roofs may be more susceptible to damage and may be less likely to be covered by insurance.

Homeowners who are struggling to understand the details of their roof insurance coverage should consider seeking the advice of a qualified insurance agent or attorney. These professionals can provide guidance and assistance in reviewing policies, filing claims, and appealing denied claims. They can also help homeowners to understand their rights and options under their policies, and to negotiate with insurance companies to obtain the coverage they need.

Steps to prepare their homes

In addition to understanding their insurance coverage, homeowners should also take steps to prepare their homes for potential natural disasters. This includes reinforcing their roofs and taking other measures to make their homes more resistant to wind and water damage. For example, homeowners can install hurricane straps or clips to secure their roofs to the walls of their homes, and can also consider installing impact-resistant windows or shutters.

Homeowners should also consider creating a disaster plan and emergency kit, which should include important documents, such as insurance policies, as well as emergency supplies, such as food, water, and first aid supplies. This will help to ensure that homeowners are prepared for any eventualities and can take action quickly in the event of a disaster.

Disaster plan

It is also worth noting that in the aftermath of a natural disaster like Hurricane Ian, there may be a large demand for roofing contractors and other service providers. Homeowners should be cautious when choosing a contractor to repair or replace their roofs, and should always check their credentials and references before hiring anyone. They should also be aware of potential scams and fraud, as some unscrupulous contractors may take advantage of homeowners during the rebuilding process.

Summary

In summary, Hurricane Ian was a powerful storm that caused significant damage to homes and businesses in its path. For homeowners, the issue of roof insurance can be a major concern, as standard policies may not provide adequate coverage for repairs or replacements. Homeowners should understand the details of their coverage and take steps to prepare their homes for potential natural disasters. By understanding their insurance policies, preparing their homes and creating a disaster plan, homeowners can be better prepared to deal with the aftermath of a natural disaster like Hurricane Ian.

About Gold Key Roofing

Our highly trained, certified roofing professionals inspect, test, evaluate and calculate all the necessary data from your project to provide your home with the ultimate protection – providing you with time-tested peace of mind.

In an industry where many roofers are in business today and out-of-business tomorrow, it is unusual to find a company like Gold Key Roofing with our experience and proven record of quality and reliability since 1975.

Roofing Services Offered in Orlando and surrounding Central Florida Areas:

| Residential Roof Repair | Roof Cleaning |

| Residential Roof Replacement | Roof Claims Assistance |

| Commercial Roof Repair | Blown-In Insulation |

| Commercial Roof Replacement |